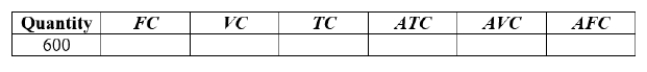

Amy owns Accurate Accounting, Inc., and her business costs for the year are as follows:

Building rent = $30,000

Accounting staff = $200,000

Supplies (e.g., paper, pencils, ink, toner) = $10,000

Annual software license = $15,000

Accurate Accounting, Inc. prepared 600 corporate tax returns for the year. Complete the following table.

Definitions:

Partner's Investment

The total capital contributed to a partnership by its members, either in cash, property, or services.

Income Ratio

A financial metric that compares different streams of income to one another or to total income, often used in profitability analysis.

Liquidation

The process of closing a business, selling its assets to pay creditors, and distributing any remaining assets to the owners or shareholders.

Gains and Losses

Increases or decreases in equity from transactions and other events and circumstances affecting the entity, other than those relating to contributions from or distributions to equity participants.

Q30: A consumer's utility function is U(X,Y) =

Q36: Suppose that the market for painting services

Q37: Mika's marginal rate of substitution of apples

Q55: (Figure: Capital and Labor IV) Which of

Q76: Nancy paid $55 for car mats but

Q83: Suppose the price of a Giffen good,

Q90: Freddy's utility function for pizza (P) and

Q107: Suppose the price of an inferior good

Q115: Suppose that you close down your coffee

Q138: (Figure: Total Cost and Quantity of Output