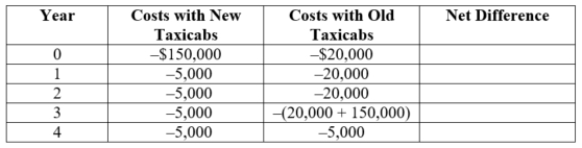

(Table: Taxi Fleet) Metro Cab is considering replacement of its fleet of old taxicabs. To replace its fleet, Metro must spend $150,000 on new taxicabs. The new taxis will incur $5,000 of maintenance expenses per year. Alternatively, Metro could spend $20,000 today to refurbish its taxicabs and incur an additional $20,000 per year of maintenance expenses for the next three years. Metro would then have to buy new taxicabs for $150,000 at the end of three years, leading to lower maintenance expenses of $5,000 per year.  Using an interest rate of 10%, the net present value of the first three years is $____.

Using an interest rate of 10%, the net present value of the first three years is $____.

Definitions:

Social Security

A government program that provides financial assistance to individuals during retirement, disability, or upon the death of a parent or spouse.

Medicare

A federal healthcare program primarily for people aged 65 and older, providing coverage for various medical services.

FICA Tax

Federal Insurance Contributions Act tax used to finance federal programs for old-age and disability benefits (social security) and health insurance for the aged (Medicare).

Payroll Tax

Taxes imposed on employers and employees, calculated as a percentage of the salaries that employers pay to their staff.

Q11: Consider Troy and Paula, each of whom

Q18: A recent willingness-to-pay survey asked respondents to

Q19: Which of the following statements is FALSE?<br>A)

Q32: Sweet Steel and Molten Metal produce sulfur

Q49: A small town has 1,000 people, 600

Q53: A drug company is considering investing $100

Q71: (Table: Firms A and B IX) Two

Q81: Suppose that a firm's potential customers succumb

Q92: Jiayi would like to save for a

Q94: Chris purchased a 21-speed road bike for