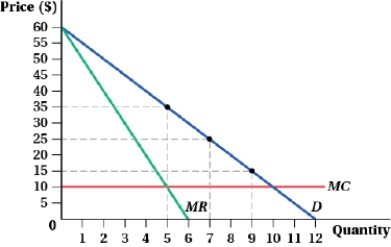

(Figure: Producer Surplus II) This firm is using block pricing, charging $35 each for the first 5 units, $25 each for units 6 and 7, and $15 for each unit beyond 7. What is the firm's producer surplus?

Definitions:

Market Portfolio

A market portfolio is a theoretical bundle of all investable assets in the market, with each asset weighted according to its market capitalization, representing the entire market or a significant segment of it.

Risk-Free Return

The theoretical return attributed to an investment with zero risk, often represented by the yield on government securities.

Jensen Measure

A risk-adjusted performance measure that calculates the average return on a portfolio or fund over and above that predicted by the Capital Asset Pricing Model (CAPM), given the portfolio's or fund's risk.

Market Portfolio

A theoretical bundle of investments that includes every asset in the market, weighted by market capitalization; often used as a benchmark in the capital asset pricing model (CAPM).

Q1: Distinguish between the following: <br>(a) Exploratory and

Q2: The conoid tubercle is located on the

Q8: Which of the following is considered a

Q23: The total number of bones in the

Q28: Ney Inc. and ARN Parts are the

Q38: Suppose that, in a two-player game, player

Q65: If the firm establishes a block-pricing structure

Q88: In a Bertrand competition, with differentiated goods

Q104: (Table: Maximum Willingness to Pay III) The

Q131: A firm with market power faces the