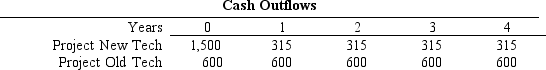

Alabama Pulp Company (APC) can control its environmental pollution using either "Project Old Tech" or "Project New Tech." Both will do the job, but the actual costs involved with Project New Tech, which uses unproved, new state-of-the-art technology, could be much higher than the expected cost levels.The cash outflows associated with Project Old Tech, which uses standard proven technology, are less risky--they are about as uncertain as the cash flows associated with an average project.APC's required rate of return for average risk projects normally is set at 12 percent, and the company adds 3 percent for high risk projects but subtracts 3 percent for low risk projects.The two projects in question meet the criteria for high and average risk, but the financial manager is concerned about applying the normal rule to such cost-only projects.You must decide which project to recommend, and you should recommend the one with the lower PV of costs.What is the PV of costs of the better project?

Definitions:

Business Users

Individuals or entities that utilize information, services, or products for business purposes, as opposed to personal use.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity, presented in a structured manner for easy understanding.

Corporation

A legal entity recognized by law as separate from its owners, with the ability to own assets, incur liabilities, and sell shares.

Retained Earnings

Accumulated net income that a company has not distributed to its shareholders as dividends, reinvested in the business.

Q3: Alice Stewart, who is the CFO of

Q29: Quantification of risk is the easiest part

Q33: As the capital budgeting director for Chapel

Q39: Which of the following statements is correct?<br>A)

Q41: When a firm issues new equity, market

Q50: Mesmer Analytic, a biotechnology firm, floated an

Q77: Assume that your required rate of return

Q78: Having synchronised cash flows enables a firm

Q82: All else equal, a zero-coupon bond's price

Q86: Calculate the current price per share (P0)