(a)

(b)

(c)

(d)

(e)

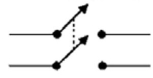

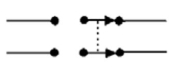

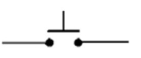

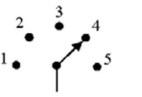

Figure

-Which switch in Figure 2-1 could be used to simultaneously open or simultaneously close two circuits?

Definitions:

LIFO Liquidation

The process of liquidating older inventory that has been valued under the Last-In, First-Out (LIFO) accounting method, which can have tax and profit implications.

Tax Ramifications

The potential consequences and effects that specific tax laws and policies can have on an individual's or company's financial situation.

FIFO

FIFO, or First-In, First-Out, is an inventory valuation method where goods first bought are the first to be sold.

Replacement Cost

The current cost of replacing an asset with a new one of the same kind and quality.

Q2: The quantity of lines of force per

Q18: The movement of free electrons through a

Q22: If four parallel 10 <span

Q26: In a resonant circuit, as Q increases

Q27: Calculate V<sub>R2</sub> and V<sub>R3</sub> in

Q32: What is the key differenceW hen taking

Q49: Kirchhoffʹs Voltage Law states that the algebraic

Q54: If RC and RL differentiators with equal

Q56: An RC integrating circuit is a basic

Q107: If the cathode voltage of a forward