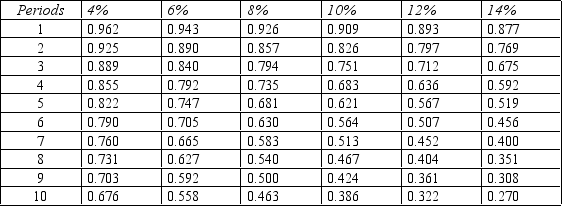

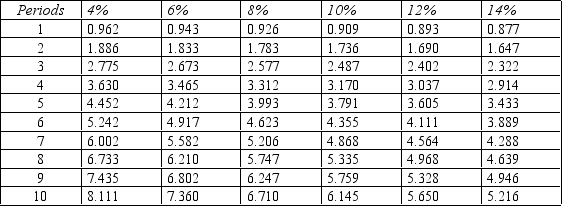

Figure 14-10.

Present value of $1

Present value of an Annuity of $1

Present value of an Annuity of $1

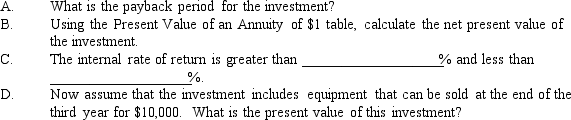

-Refer to Figure 14-10. Geary Company is considering an investment costing $110,000. The investment would return $40,000 per year in each of three years. Geary requires a minimum rate of return of 10%.

Definitions:

Nonparticipating

Typically refers to insurance policies or preferred stock where the holders do not have the right to share in certain dividends beyond the specified rate or in the surplus assets.

Dividends

Payments made by a corporation to its shareholder members. It is the share of profits and retained earnings that the company pays out to its shareholders.

Paid-In Capital

Funds raised by a company from investors through the issuance of stock, excluding any amounts derived from retained earnings.

Fair Market Value

The price that property would sell for on the open market between a willing buyer and a willing seller.

Q14: Which of the following is true regarding

Q35: _ are the future cash flows expressed

Q66: Pollux Company had the following income statement

Q97: Return on sales

Q108: The internal rate of return model does

Q128: Marshal Company has the following data for

Q140: Upon review of Johnson's Statement of Cash

Q150: In negotiated transfer pricing, the selling division

Q158: _ expresses a line item as a

Q181: If accounts receivable have increased during the