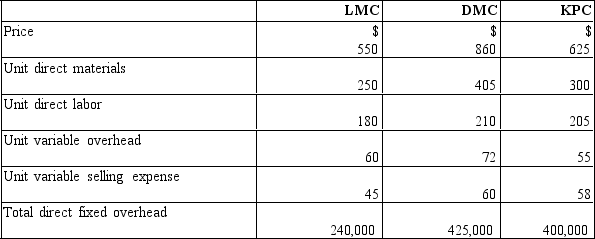

Mario Co. produces three products: LMC, DMC, KPC. For the coming year they expect to produce 160,000 units. Of these, 65,000 will be LMC, 40,000 will be DMC and 55,000 will be KPC. The following information was provided for the coming year:

Common fixed overhead is $984,000 and fixed selling and administrative expenses for Mario Co. is $881,000 per year.

Common fixed overhead is $984,000 and fixed selling and administrative expenses for Mario Co. is $881,000 per year.

Required:

A. Calculate the unit variable cost under variable costing.

B. Calculate the unit variable product cost.

C. Prepare a segmented variable-costing income statement for next year.

D. Should Mario Co. keep all product lines?

Definitions:

Vertical Integration

A strategy where a company expands its business operations into different steps on the same production path, such as when a manufacturer owns its supplier and/or distributor.

Singer Sewing Machines

A historically significant brand that played a key role in the development and mass production of sewing machines, changing the textile industry.

Indian Lands

Territories inhabited or historically owned by indigenous peoples of the Americas prior to European colonization and often the subject of conflict and negotiation thereafter.

Late Nineteenth Century

Refers to the period from around 1870 to 1900, marked by significant industrial, social, and political changes worldwide.

Q12: Perfect Builders makes all sorts of moldings.

Q15: Refer to Figure 7-5. Calculate an activity

Q60: Which of the following is the most

Q84: The _ shows the expected cost of

Q103: Refer to Figure 4-2. What is the

Q112: Assume that the accounts payable department of

Q159: Refer to Figure 6-1. Department Z's cost

Q160: All of the following are supplier-driven activities

Q162: The time required to produce one unit

Q181: _ gives us a way to determine