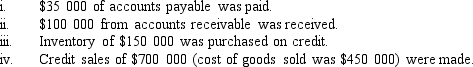

Consider the following information:  What is the profit for the period?

What is the profit for the period?

Definitions:

Federal Unemployment Tax Rate

A tax rate set by the federal government to fund unemployment compensation payments to workers who have lost their jobs.

Salaries Payable

Salaries payable is an account that records the amounts owed to employees for work performed but not yet paid.

Employer's Payroll Tax Expense

Taxes that employers are required to pay on behalf of their employees, such as Social Security and Medicare taxes, often based on a percentage of the employees' wages.

Gross Payroll

The total amount of money paid by a business to its employees before any deductions are made.

Q2: When using the floating fastener assembly, after

Q4: A(n) _ is where the allowable variation

Q5: Where a width is used as a

Q5: Continued use of the fuels most relied

Q9: The function of a product determines the

Q10: When a company discards machinery that is

Q13: What is a tolerance analysis chart?

Q13: The ASME _ are published by the

Q16: Which of the following should NOT be

Q18: Diligent Ltd had five units of the