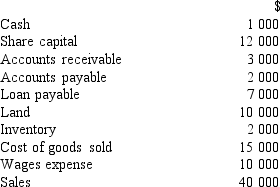

LPR is a company that commenced business on 1 January 2019. Below are the balances in the 30 June 2019 financial statements.  What is the net profit for the period ending 30 June 2019?

What is the net profit for the period ending 30 June 2019?

Definitions:

Operating Cash Inflow

Funds that are generated from a company's normal business operations, reflecting the cash inflows from selling goods and services.

Working Capital

The difference between a company's current assets and its current liabilities, indicating the liquid assets available for day-to-day operations.

Straight-Line Depreciation

A way of allocating an asset's expenditure smoothly over its effective life.

After-Tax Discount Rate

The interest rate used in discounting cash flows that takes into account the tax implications of the investment.

Q1: On 1 January 2019, Sky-High Ltd acquired

Q2: Highrise Constructions Ltd had a large three-year

Q3: Where a perpendicularity tolerance is applied to

Q7: The external auditor renders an 'except for'

Q13: In certain applications, the function of a

Q18: A summary of the entries in the

Q20: The following information is taken from the

Q24: Which of the following could NOT explain

Q25: ABC buys a 25 per cent share

Q27: LPR is a company that commenced business