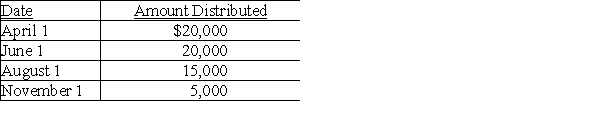

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Fixed Expenses

Costs that do not fluctuate with changes in production level or sales volume.

Avoidable Expenses

Costs that can be eliminated if a certain decision is made, such as discontinuing a product line.

Financial Advantage

A benefit enjoyed by an entity that puts it in a stronger financial position, such as lower costs, greater revenues, or superior investment returns.

Avoidable Expenses

Costs that can be eliminated if a particular decision is made, such as discontinuing a product or service.

Q11: Which of the following statements best describes

Q12: Khuns Corporation, a personal holding company, reports

Q23: Identify which of the following statements is

Q38: Identify which of the following statements is

Q51: The personal holding company tax<br>A)may be imposed

Q61: Exit Corporation has accumulated E&P of $24,000

Q69: An automatic extension of time from the

Q72: When computing corporate taxable income, what is

Q84: AT Pet Spa is a partnership owned

Q101: Lucy files her current-year individual income tax