Essay

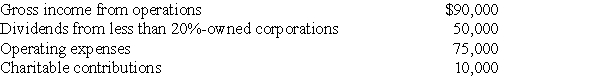

Dexter Corporation reports the following results for the current year:  In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income for the current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income for the current year?

Recognize the impact of human activities on wildlife and the importance of conservation strategies.

Understand the concept of reconciliation ecology and its role in preserving biodiversity.

Awareness of the challenges in controlling the illegal wildlife trade and the impact of exotic pets on native species.

Understand the impact of alien species in new ecosystems and factors causing the depletion of the environment.

Definitions:

Related Questions

Q20: One of your corporate clients comes to

Q26: Joyce passed away on January 3 while

Q34: Income is "effectively connected" with the conduct

Q47: What impact does an NOL carryforward have

Q55: In 2017, Phoenix Corporation is a controlled

Q58: Which one of the following statements about

Q75: U.S. citizens, resident aliens, and domestic corporations

Q83: Mario and Lupita form a corporation in

Q86: When appreciated property is distributed in a

Q105: Two corporations are considered to be brother-sister