Multiple Choice

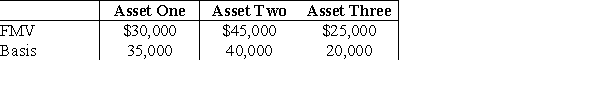

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec. 351.  Max's recognized gain is

Max's recognized gain is

Definitions:

Related Questions

Q3: What is the effect of the two-pronged

Q17: Explain the alternatives available to individual taxpayers

Q17: A shareholder's basis in property distributed as

Q23: Identify which of the following statements is

Q35: For the first five months of its

Q55: Tia receives a $15,000 cash distribution from

Q57: Lass Corporation reports a $25,000 net capital

Q61: Property received in a corporate liquidation by

Q89: The following items were discovered in reviewing

Q93: Jerry transfers two assets to a corporation