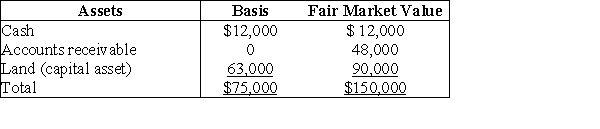

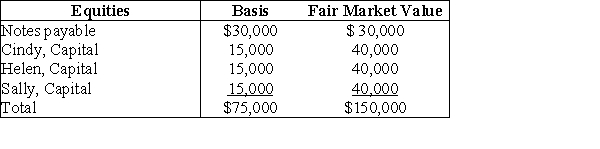

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is $25,000. What gain/loss should she report for tax purposes?

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is $25,000. What gain/loss should she report for tax purposes?

Definitions:

Dicta

Comments made by a judge in a court opinion that are not essential to the decision and therefore not legally binding as precedent.

Court's Statements

Official pronouncements or declarations made by a judge or court of law regarding a legal matter or case.

Court's Decision

The final judgment or order given by a court in legal proceedings.

Concurring Opinion

An additional written opinion by a judge who agrees with the decision of the court but wants to make a particular point that was not made or emphasized in the majority opinion.

Q4: Which of the following statements best describes

Q13: Final regulations can take effect on any

Q16: Administration expenses incurred by an estate<br>A)are deductions

Q32: Income in respect of a decedent (IRD)is

Q32: "Pan-Indianism" refers to the:<br>A)development of an "Indian"

Q68: Identify which of the following statements is

Q69: Jack transfers property worth $250,000 to a

Q85: Explain how shares of stock traded on

Q95: Identify which of the following statements is

Q101: The CHS Partnership's balance sheet presented below