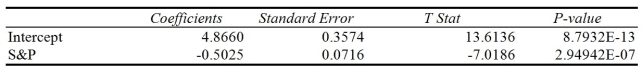

TABLE 12-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 Index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 Index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 Index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 Index at a 5% level of significance. The results are given in the following Microsoft Excel output.

Note: 2.94942E-07 = 2.94942 * 10-7

-Referring to Table 12-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 Index, the appropriate null and alternative hypotheses are, respectively,

Definitions:

Performance Deficiencies

Gaps between actual and expected performance levels in individuals or organizations, often necessitating corrective actions.

Productivity Standards

Defined benchmarks or criteria that specify the expected amount of work to be completed within a certain time frame, often used to measure employee performance.

United Parcel Service

An American multinational package delivery and supply chain management company known for its brown delivery trucks and uniforms, often referred to by its acronym UPS.

Motion Studies

The systematic study of the human motions used in work processes, aiming to improve efficiency by reducing unnecessary motions and simplifying tasks.

Q9: Referring to Table 11-8, at 5% level

Q9: Referring to Table 12-3, the total sum

Q44: Referring to Table 12-10, 93.98% of the

Q48: Referring to Table 13-16, what is the

Q87: Referring to Table 12-3, the director of

Q135: Referring to Table 12-10, the null hypothesis

Q171: If you wish to determine whether there

Q172: Referring to Table 10-15, what is the

Q184: Referring to Table 13-7, the department head

Q275: Referring to Table 10-4, the p-value for