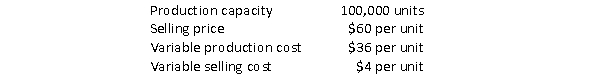

The Transformer division of Lorman Industries produces transformers that can be sold to outside customers or transferred to the Electronics division of the company.The following information has been collected by Lorman's controller:  Electronics need 6,000 transformers.If the Transformer division transfers its units to the Electronics division, it can avoid $2 of the variable selling cost.

Electronics need 6,000 transformers.If the Transformer division transfers its units to the Electronics division, it can avoid $2 of the variable selling cost.

Required:

a.If the Transformer division can only sell 80,000 units to outside customers, what is the lowest acceptable transfer price that it is willing to accept for the 6,000 units?

b.If the Transformer division can sell all 100,000 units to outside customers, list three courses of actions that the division might consider providing the units to Electronics.

Definitions:

Dividends Received

Income payments received by shareholders from their investments in the form of dividends from corporations.

Investment Account

An account that holds securities, shares, or bonds for investment purposes.

Acquisition Differential

The difference between the purchase price of a company and the fair value of its identifiable net assets at the acquisition date, often leading to goodwill if positive.

Non-Controlling Interest

A minority share in a company's equity not sufficient to exert control over the company.

Q36: Instead of maximizing income, as measured by

Q42: Which of the following strategies relates to

Q47: Estimated costs for activity cost pools and

Q59: When using the balanced scorecard to monitor

Q100: Ron Jensen, the controller of Inca Industries,

Q100: Which of the following is considered a

Q106: To be of any value, a measure

Q109: Woods Manufacturing is considering the purchase of

Q130: Activity-based costing did not gain widespread popularity

Q166: Which of the following statements is true?<br>A)If