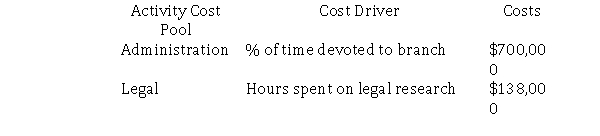

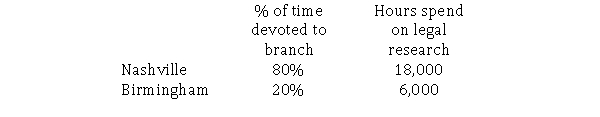

Brandon Consulting Company is headquartered in Atlanta and has branch offices in Nashville and Birmingham.Brandon uses an activity-based costing system.The Atlanta office has its costs for Administration and Legal allocated to the two branch offices.Brandon has provided the following information:

How much of Atlanta's cost will be allocated to Birmingham?

How much of Atlanta's cost will be allocated to Birmingham?

Definitions:

Commissions

A form of payment to an employee based on completing a task or making a sale, often a percentage of the sale amount.

Merit Pay

Pay increase given to employees based on their job performance, as a reward for their contributions towards organizational goals.

Indirect Pay

Compensation that includes benefits not given directly as cash, such as health insurance, retirement plans, and paid time off.

Income Tax Treatment

Refers to the way tax laws are applied to an individual's or entity's income, including deductions, exemptions, and the calculation of taxes owed.

Q3: Which of the following is not a

Q5: Birch manufacturing is considering the addition of

Q21: Which of the following is a weakness

Q44: If a company uses more direct labor

Q57: Which of the following is a reason

Q93: Which of the following is not a

Q101: R&W Manufacturing Company produces men's hiker shorts.The

Q106: A characteristic of non-value-added activities is that

Q121: The costs that should be included in

Q160: The difference between actual units sold and