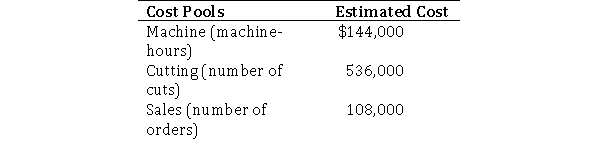

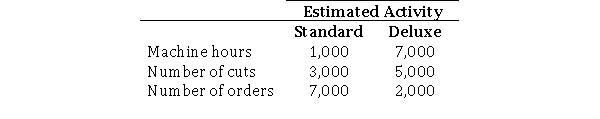

Angora, Inc.uses activity-based costing to cost its two products: Standard and Deluxe.The company has provided the following data relating to its activities:

Required:

Required:

a.What is the activity rate for the cutting cost pool?

b.If actual activity is the same as that estimated, what is the total amount of overhead cost allocated to the Standard product?

Definitions:

Price-Earnings Ratio

A valuation ratio of a company's current share price compared to its per-share earnings, used to evaluate if a stock is over or undervalued.

Market Price

The present rate at which a service or asset is being traded.

Net Income

The final amount of money a company makes after removing all operational costs, taxes, and additional expenses from the overall income.

Return On Common Stockholders' Equity

A financial ratio that measures the profitability of a company from the perspective of common stockholders, calculated by dividing net income available to common shareholders by average common stockholder's equity.

Q31: Which of the following is typically held

Q36: Because fixed overhead does not vary with

Q47: The formula for the production budget is

Q97: The direct materials price variance is based

Q109: Which of the following is considered a

Q110: Which of the following is not a

Q136: Morgan's, Inc.has provided you with the following

Q136: The following list includes activities that are

Q143: Nora, Inc.manufactures components used by a major

Q147: To determine the present value of any