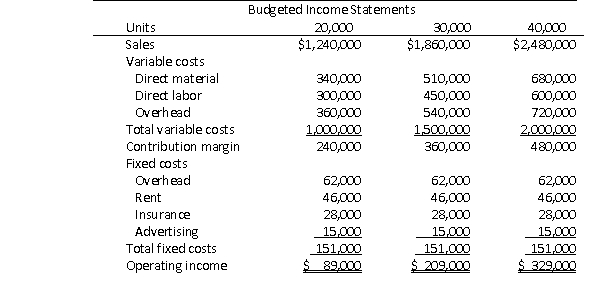

Kevin Jarvis is the controller of Bitterroot Industries.Kevin prepared the following budgeted income statement at various levels of sales.After careful review of the budgeted income statements, and after discussions with the sales and production managers, the CEO determines that the best alternative is to base the budget on a sales volume of 30,000 units.  Actual results for the year were 28,000 units, reflected in the following income statement:

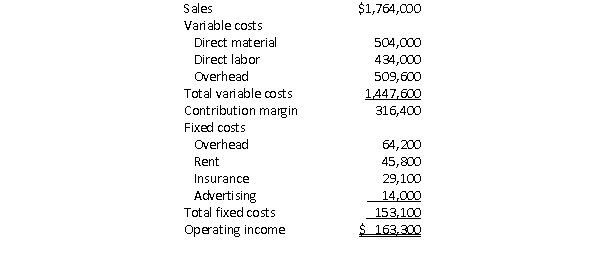

Actual results for the year were 28,000 units, reflected in the following income statement:  What is the sales volume variance for direct labor?

What is the sales volume variance for direct labor?

Definitions:

GAAP

GAAP refers to the widely recognized set of accounting norms and guidelines followed in the U.S. for preparing financial statements.

Fair Value

The amount one would obtain from selling an asset or the cost to transfer a liability, in a smooth transaction with market players on the day of valuation.

Identifiable Intangible Assets

Non-physical assets that can be separated from the company and sold, transferred, or leased, such as patents and trademarks.

Incurred Costs

Expenses that have been realized or consumed in the operations of a business, typically reflected through the charging of expenses.

Q54: You are part of a team responsible

Q55: A bottom-up approach to budgeting is circular

Q56: Terra Mesa Manufacturing uses a job order

Q74: Which of the following is not a

Q78: Which of the following is not a

Q112: Phillip Co.manufactures decorative pillows designed for use

Q130: According to the theory of constraints, which

Q149: The key to reducing costs through activity

Q166: Which of the following statements is true?<br>A)If

Q193: A variance is labeled as "favorable" or