The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

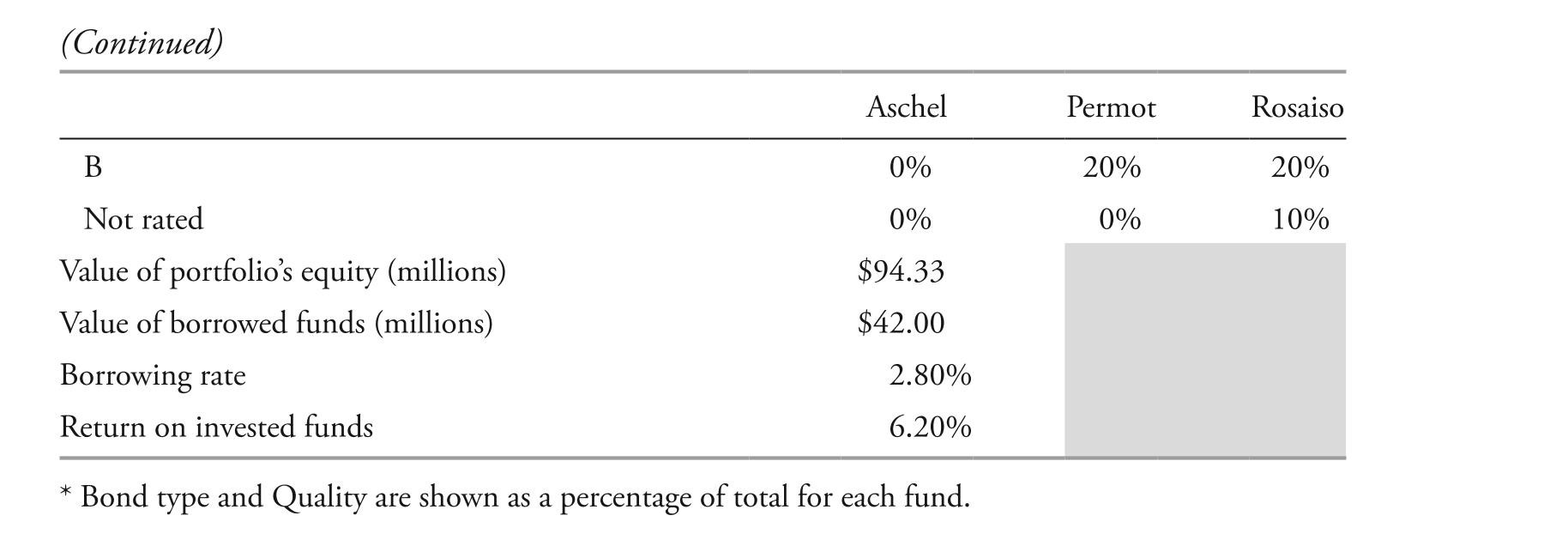

EXHIBIT 1 Selected Data on Fixed-Income Funds

after further review of the composition of each of the funds, Perreaux notes the following.

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

-based on exhibit 1, which fund provides the highest level of protection against inflation for coupon payments?

Definitions:

Positive Economic Statement

An objective statement about the economy that can be tested and validated through observation.

Government Control

The involvement or intervention by governmental bodies in regulating or directing economic activities, market practices, and industry standards.

Rent

A periodic payment made to an owner for the use of their property, especially for living in an apartment or leasing a commercial space.

Housing

Refers to residential structures that provide shelter or accommodation, including apartments, houses, and other types of living spaces.

Q2: Find the domain of the function.<br>

Q6: A simply supported steel beam of

Q7: Support reaction <span class="ql-formula" data-value="C

Q8: Use a graphing utility to graph the

Q15: Select the graph of the polar

Q22: Is Madison correct in describing key differences

Q24: Find the values of <span

Q40: Find the limit. <span class="ql-formula"

Q70: An open rectangular box with volume

Q99: <span class="ql-formula" data-value="\text { If } f