The following information relates to Questions

daniela ibarra is a senior analyst in the fixed-income department of a large wealth manage-ment firm. Marten Koning is a junior analyst in the same department, and david lok is a member of the credit research team.

The firm invests in a variety of bonds. ibarra is presently analyzing a set of bonds with some similar characteristics, such as four years until maturity and a par value of €1,000. exhibit 1 includes details of these bonds.

exhibit 1 a brief description of the bonds being analyzed bond descriptionb1 a zero-coupon, four-year corporate bond with a par value of €1,000. The wealth management firm's research team has estimated that the risk-neutral probability of default (the hazard rate) for each date for the bond is 1.50%, and the recovery rate is 30%.b2 a bond similar to b1, except that it has a fixed annual coupon rate of 6% paid annually.

b3 a bond similar to b2 but rated aa.

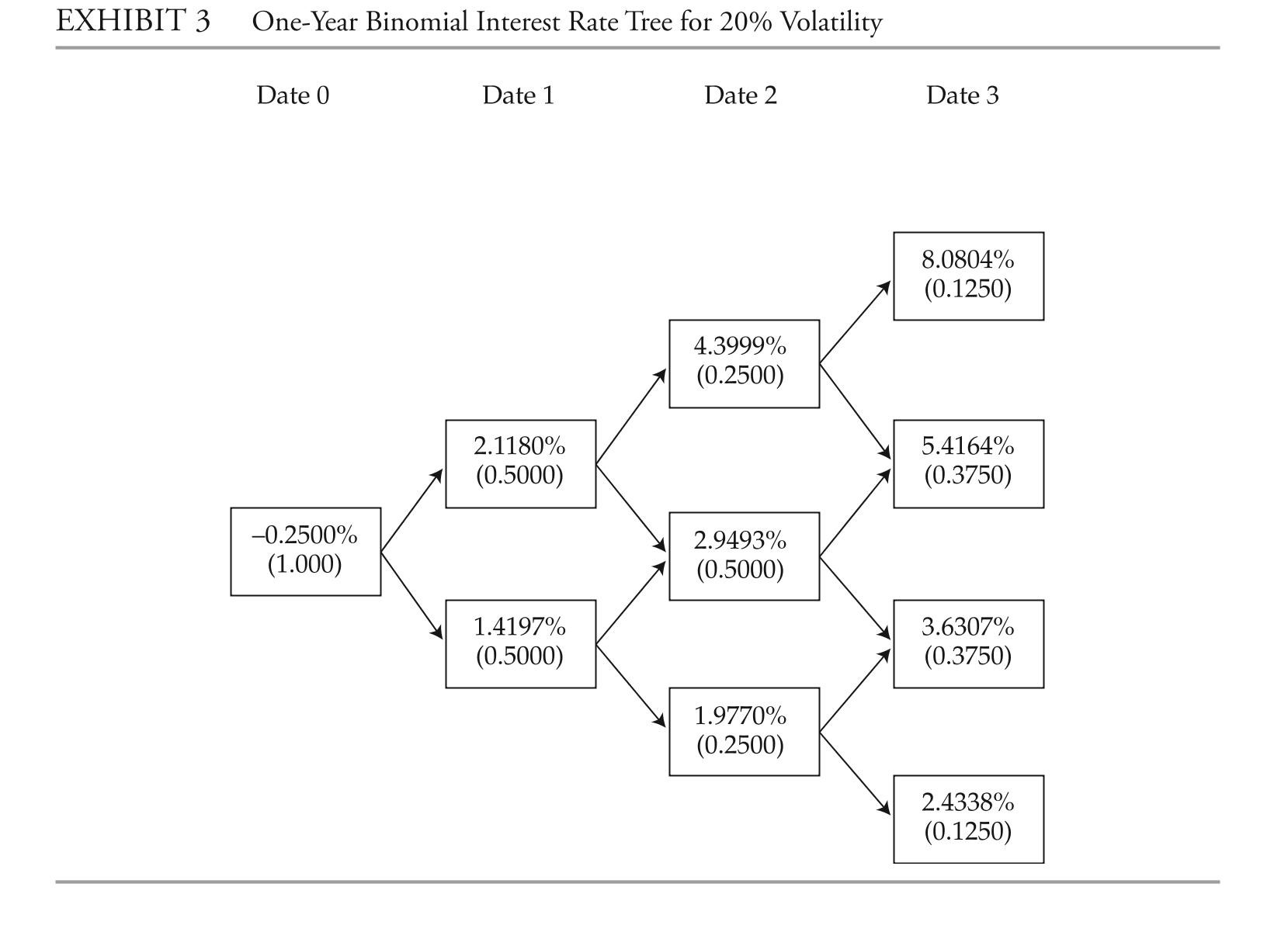

b4 a bond similar to b2 but the coupon rate is the one-year benchmark rate plus 4%.ibarra asks Koning to assist her with analyzing the bonds. She wants him to perform the analysis with the assumptions that there is no interest rate volatility and that the government bond yield curve is flat at 3%.ibarra performs the analysis assuming an upward-sloping yield curve and volatile interest rates. exhibit 2 provides the data on annual payment benchmark government bonds.1 She uses these data to construct a binomial interest rate tree (shown in exhibit 3) based on an assump-tion of future interest rate volatility of 20%.

1 For simplicity, this exhibit uses

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

Note: all calculations in this problem set are carried out on spreadsheets to preserve reci-sion. The rounded results are reported in the solutions.

-The fair value of bond b2 is closest to:

Definitions:

Diverse Factions

Groups or cliques within a larger community or organization that have varying backgrounds, interests, and perspectives, potentially leading to rich diversity but also conflict.

Confederation Congress

A body that governed the United States from 1781 to 1789, functioning as the government before the Constitution was ratified.

Prewar Debts

Debts accrued by nations prior to the onset of a major conflict, often complicating postwar economic recovery.

Great Lakes

A group of five large, interconnected freshwater lakes located on the border between the United States and Canada, constituting the largest group of freshwater lakes by surface area.

Q8: Collateralized mortgage obligations (CMos) are designed to:<br>A)

Q11: Consider a line with slope m

Q15: based on exhibit 1, the best action

Q15: based on exhibit 1, the loss given

Q24: The capital gain/loss per 100 of par

Q30: based on Exhibit 1, the results of

Q35: Solve the exponential equation algebraically. Approximate

Q36: which of the following conclusions regarding the

Q41: Eliminate the parameter and write the

Q107: Classify the function as a Polynomial