The following information relates to Questions

daniela ibarra is a senior analyst in the fixed-income department of a large wealth manage-ment firm. Marten Koning is a junior analyst in the same department, and david lok is a member of the credit research team.

The firm invests in a variety of bonds. ibarra is presently analyzing a set of bonds with some similar characteristics, such as four years until maturity and a par value of €1,000. exhibit 1 includes details of these bonds.

exhibit 1 a brief description of the bonds being analyzed bond descriptionb1 a zero-coupon, four-year corporate bond with a par value of €1,000. The wealth management firm's research team has estimated that the risk-neutral probability of default (the hazard rate) for each date for the bond is 1.50%, and the recovery rate is 30%.b2 a bond similar to b1, except that it has a fixed annual coupon rate of 6% paid annually.

b3 a bond similar to b2 but rated aa.

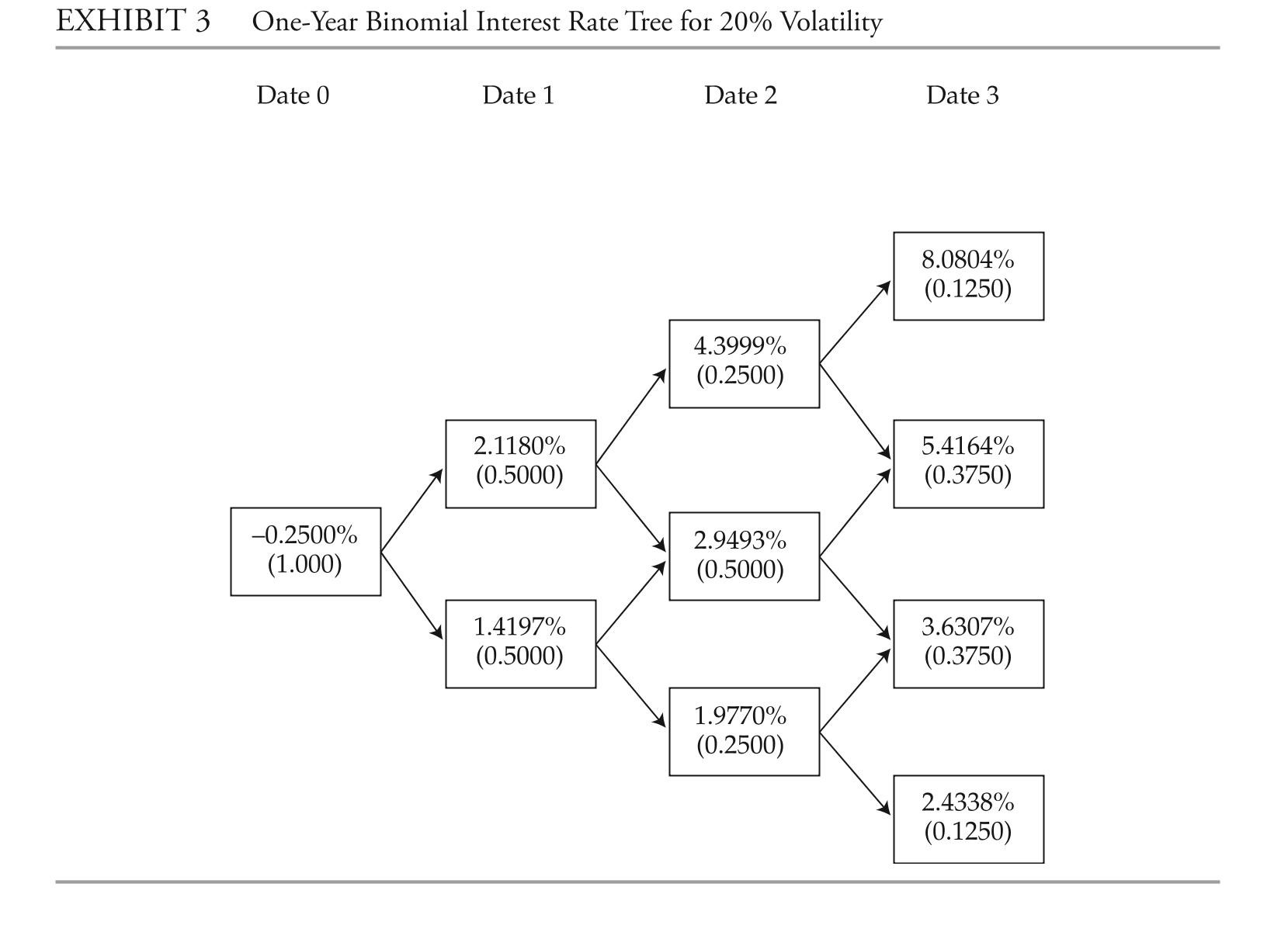

b4 a bond similar to b2 but the coupon rate is the one-year benchmark rate plus 4%.ibarra asks Koning to assist her with analyzing the bonds. She wants him to perform the analysis with the assumptions that there is no interest rate volatility and that the government bond yield curve is flat at 3%.ibarra performs the analysis assuming an upward-sloping yield curve and volatile interest rates. exhibit 2 provides the data on annual payment benchmark government bonds.1 She uses these data to construct a binomial interest rate tree (shown in exhibit 3) based on an assump-tion of future interest rate volatility of 20%.

1 For simplicity, this exhibit uses

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

Note: all calculations in this problem set are carried out on spreadsheets to preserve reci-sion. The rounded results are reported in the solutions.

-Floating-rate note b4 is currently rated bbb by Standard & Poor's and Fitch ratings (and baa by Moody's investors Service) . based on the research department assumption about

The probability of default in Question 10 and her own assumption in Question 11, which

Action does ibarra most likely expect from the credit rating agencies?

Definitions:

Investment

The act of allocating resources, usually money, in the expectation of generating an income or profit.

Government Bonds

Debt securities issued by a government to support government spending and obligations.

Mutual Funds

Investment programs funded by shareholders that trade in diversified holdings and are professionally managed.

Borrowed Funds

Money that has been obtained through loans or credit, typically subject to repayment with interest.

Q17: Given the description of the asset pool

Q17: <span class="ql-formula" data-value="\text { Find the interval(s)

Q25: a bond that is characterized by a

Q26: Select the graph of the following

Q27: Support tranches are most appropriate for investors

Q30: Use the One-to-One Property to solve

Q31: if the market price of Pro Star's

Q44: Write the exponential equation in logarithmic

Q67: Sketch the graph of the function

Q96: <span class="ql-formula" data-value="\text { Find the limit