The following information relates to Questions

daniela ibarra is a senior analyst in the fixed-income department of a large wealth manage-ment firm. Marten Koning is a junior analyst in the same department, and david lok is a member of the credit research team.

The firm invests in a variety of bonds. ibarra is presently analyzing a set of bonds with some similar characteristics, such as four years until maturity and a par value of €1,000. exhibit 1 includes details of these bonds.

exhibit 1 a brief description of the bonds being analyzed bond descriptionb1 a zero-coupon, four-year corporate bond with a par value of €1,000. The wealth management firm's research team has estimated that the risk-neutral probability of default (the hazard rate) for each date for the bond is 1.50%, and the recovery rate is 30%.b2 a bond similar to b1, except that it has a fixed annual coupon rate of 6% paid annually.

b3 a bond similar to b2 but rated aa.

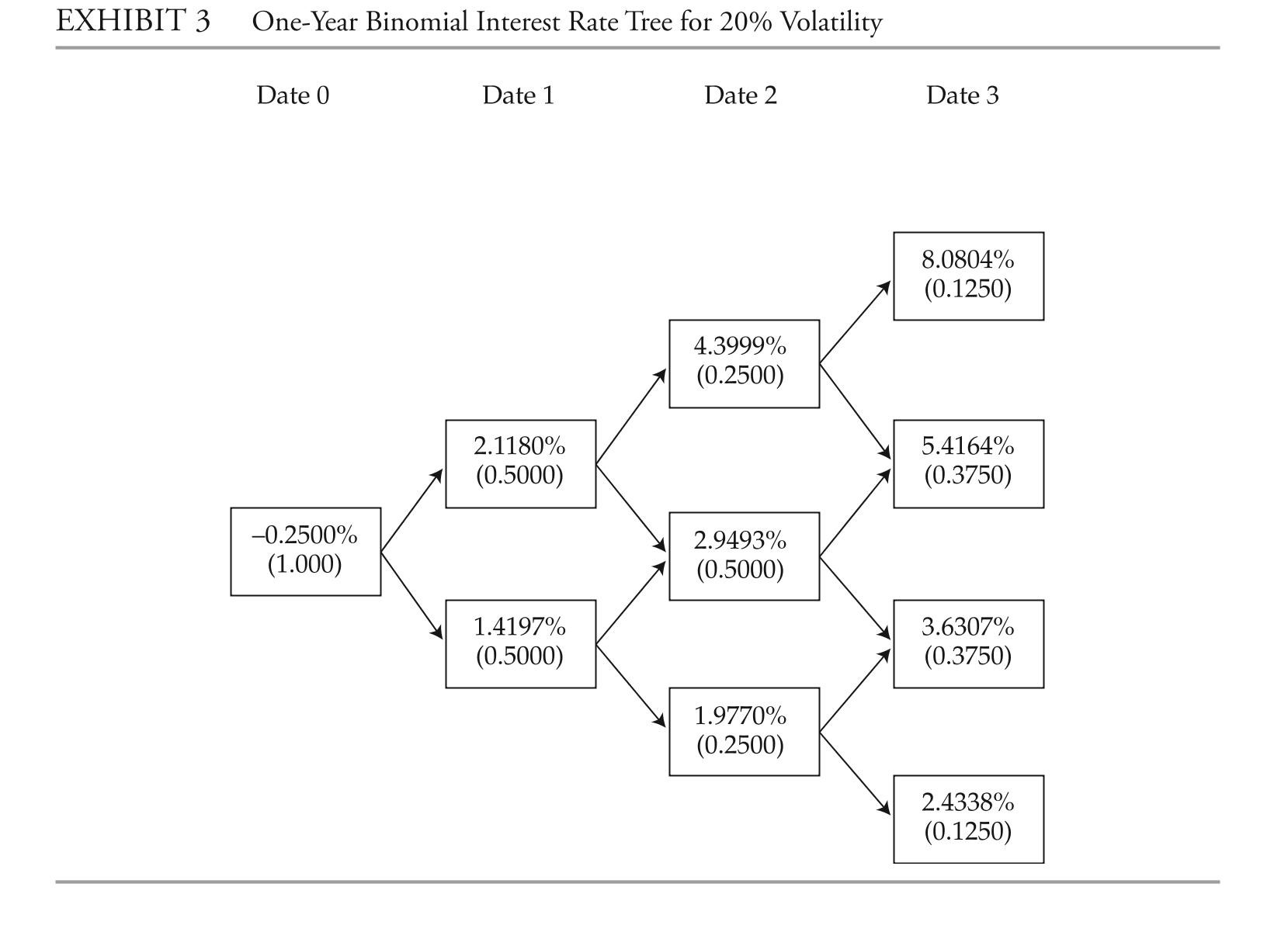

b4 a bond similar to b2 but the coupon rate is the one-year benchmark rate plus 4%.ibarra asks Koning to assist her with analyzing the bonds. She wants him to perform the analysis with the assumptions that there is no interest rate volatility and that the government bond yield curve is flat at 3%.ibarra performs the analysis assuming an upward-sloping yield curve and volatile interest rates. exhibit 2 provides the data on annual payment benchmark government bonds.1 She uses these data to construct a binomial interest rate tree (shown in exhibit 3) based on an assump-tion of future interest rate volatility of 20%.

1 For simplicity, this exhibit uses

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

answer the first five questions (1-4) based on the assumptions made by Marten Koning,the junior analyst. answer questions (8-12) based on the assumptions made by daniela ibarra, the senior analyst.

Note: all calculations in this problem set are carried out on spreadsheets to preserve reci-sion. The rounded results are reported in the solutions.

-during the presentation about how the research team estimates the probability of default for a particular bond issuer, lok is asked for his thoughts on the shape of the

Term structure of credit spreads. Which statement is he most likely to include in his

Response?

Definitions:

Social Anxiety Disorder

A chronic mental health condition characterized by overwhelming anxiety and excessive self-consciousness in everyday social situations.

Role-playing

A method or technique used in training and therapy that involves acting out roles or situations to practice skills, understand a perspective, or predict the outcome of an interaction.

Reinforcement

A process in behavior analysis that increases the likelihood of a behavior being repeated by applying a rewarding stimulus or removing a negative one.

Cognitive-behavioral Theorists

Psychologists who emphasize the role of thought patterns and beliefs in influencing behavior and emotions, often proposing therapy approaches to modify these.

Q2: cantilever beam is loaded as shown in

Q8: bond b3 will have a modified duration

Q9: Which of the following type of debt

Q12: based on exhibit 2, relative to Portfolio

Q16: Which of the following describes a typical

Q18: relative to approach 2 of gaining passive

Q34: Use inverse functions where needed to

Q67: Sketch the graph of the function

Q88: A point in polar coordinates is

Q115: <span class="ql-formula" data-value="\text { Let } f