The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

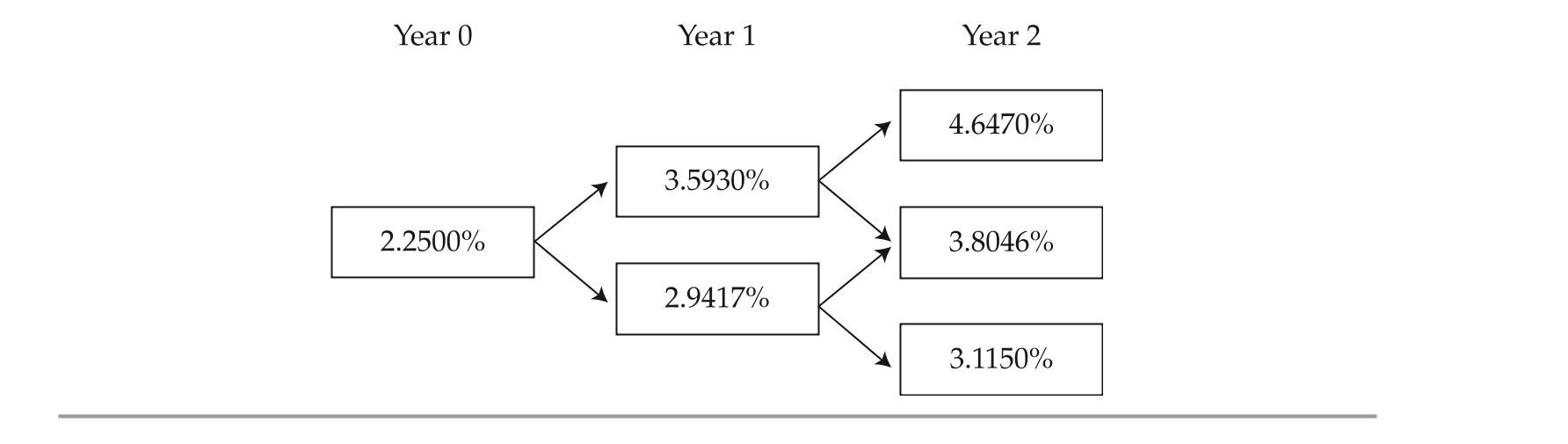

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-A fall in interest rates would most likely result in:

Definitions:

Marginal Cost

The financial commitment needed to produce an additional unit of a product or service.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits you could have received by taking an alternative action.

Movieplex

A modern movie theater complex featuring multiple screens within a single venue, allowing for the screening of various films simultaneously.

Coupon

A voucher or code that entitles the holder to a discount off a particular product or service, or a certificate of interest payment on a bond.

Q4: Determine which alternative portfolio in exhibit 1

Q5: if the assumed volatility is changed as

Q8: Vector <span class="ql-formula" data-value="V _

Q8: An aluminum light pole weighs 4300

Q12: The most appropriate response to Kowalski's question

Q12: plane truss with span length L

Q26: Compared with developed markets bonds, emerging markets

Q30: A 3-year bond offers a 10%

Q52: Which term structure model can be calibrated

Q157: Graph the function by hand, not