The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

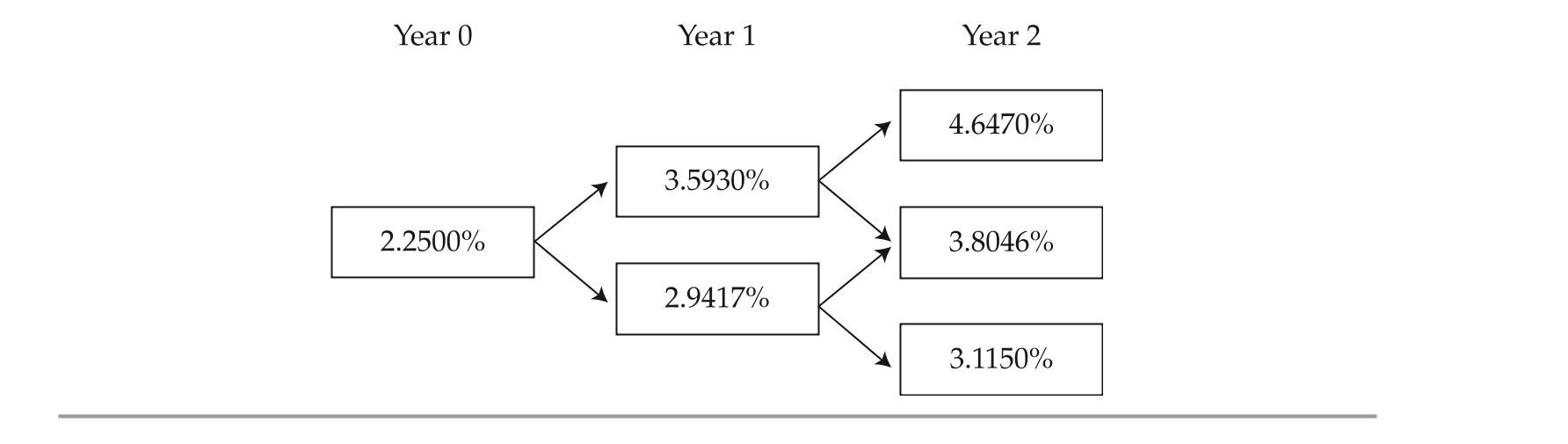

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-All else being equal, if the shape of the yield curve changes from upward sloping to flat- tening, the value of the option embedded in Bond 2 will most likely:

Definitions:

Second-Generation Pesticides

Pesticides developed to overcome resistance or environmental concerns associated with first-generation pesticides, often designed to be more targeted or biodegradable.

Spiders

Arachnids characterized by eight legs, typically spinning webs to capture prey, and playing a significant role in controlling insect populations.

Spruce Budworm

A destructive North American caterpillar that infests conifer forests, notably spruce and fir trees, causing significant damage to these ecosystems during outbreak periods.

Pheromones

Substances created and emitted by an animal into its surroundings that influence the behavior or bodily functions of other members of the same species.

Q1: centroid of the parallelogram shown in

Q1: if benchmark yields were to fall, which

Q6: Suppose a bond’s price is expected to

Q9: When underwriting new corporate bonds, matrix pricing

Q10: In credit card receivable aBS, principal cash

Q12: Eliminate the parameter and write the

Q17: Find the distance between the point

Q28: Based on Exhibit 4, the arbitrage-free value

Q102: <span class="ql-formula" data-value="s ( t )"><span class="katex"><span

Q125: <span class="ql-formula" data-value="\text { Find the function