The following information relates to Questions 11-19

Rayes investment Advisers specializes in fixed-income portfolio management. Meg Rayes, the owner of the firm, would like to add bonds with embedded options to the firm's bond port-folio. Rayes has asked Mingfang Hsu, one of the firm's analysts, to assist her in selecting and analyzing bonds for possible inclusion in the firm's bond portfolio.Hsu first selects two corporate bonds that are callable at par and have the same character-istics in terms of maturity, credit quality and call dates. Hsu uses the option-adjusted spread(oAS) approach to analyse the bonds, assuming an interest rate volatility of 10%. The resultsof his analysis are presented in Exhibit 1.

EXHIBIT 1 Summary Results of Hsu's Analysis Using the OAS Approach

Hsu then selects the four bonds issued by Rw, inc. given in Exhibit 2. These bonds all have a maturity of three years and the same credit rating. Bonds 4 and 5 are identical to Bond3, an option-free bond, except that they each include an embedded option.

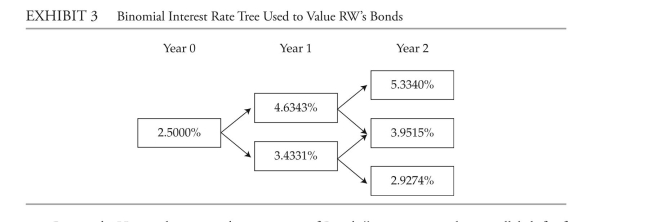

To value and analyze Rw's bonds, Hsu uses an estimated interest rate volatility of 15% and constructs the binomial interest rate tree provided in Exhibit 3.

Rayes asks Hsu to determine the sensitivity of Bond 4's price to a 20 bps parallel shift ofthe benchmark yield curve. The results of Hsu's calculations are shown in Exhibit 4.EXHiBiT 4 Summary Results of Hsu's Analysis about the Sensitivity of Bond 4's Price to a ParallelShift of the Benchmark yield Curve Magnitude of the Parallel Shift in the Benchmark yield Curve +20 bps −20 bps full Price of Bond 4 (% of par) 100.478 101.238 Hsu also selects the two floating-rate bonds issued by Varlep, plc given in Exhibit 5. These

bonds have a maturity of three years and the same credit rating.

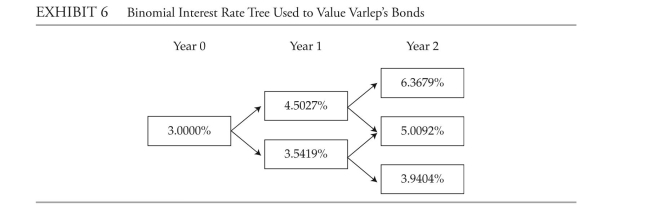

To value Varlep's bonds, Hsu constructs the binomial interest rate tree provided inExhibit 6.

last, Hsu selects the two bonds issued by whorton, inc. given in Exhibit 7. These bonds are close to their maturity date and are identical, except that Bond 9 includes a conversion option. whorton's common stock is currently trading at $30 per share.

-in Exhibit 2, the bond whose effective duration will lengthen if interest rates rise is:

Definitions:

Human Development

The multidimensional process of physical, cognitive, and socioemotional growth and change over the human lifespan.

Down Syndrome

A condition resulting from having an entire or partial extra copy of chromosome 21, which causes delays in both intellectual and developmental growth.

Personal Fable

A belief held by some adolescents that they are special, unique, and invulnerable.

Imaginary Audience

A psychological concept where an individual believes that their behavior or actions are the focus of others’ attention.

Q3: <span class="ql-formula" data-value="\text { A cylinder of

Q4: brass rod of length L =

Q5: Perform the multiplication and use the

Q8: Collateralized mortgage obligations (CMos) are designed to:<br>A)

Q32: Find the standard form of the

Q37: Use the figure to find the

Q47: <span class="ql-formula" data-value="\text { Find the numbers,

Q92: Find the domain of the function.

Q131: A stone is dropped into a

Q170: The relationship between the Fahrenheit and