The following information relates to Questions 1-6

katrina black, portfolio manager at Coral bond Management, ltd., is conducting a training session with alex Sun, a junior analyst in the fixed income department. black wants to ex-plain to Sun the arbitrage-free valuation framework used by the firm. black presents Sun with exhibit 1, showing a fictitious bond being traded on three exchanges, and asks Sun to identify the arbitrage opportunity of the bond. Sun agrees to ignore transaction costs in his analysis.exhibit 1 Three-Year, €100 par, 3.00% Coupon, annual-Pay option-Free bond

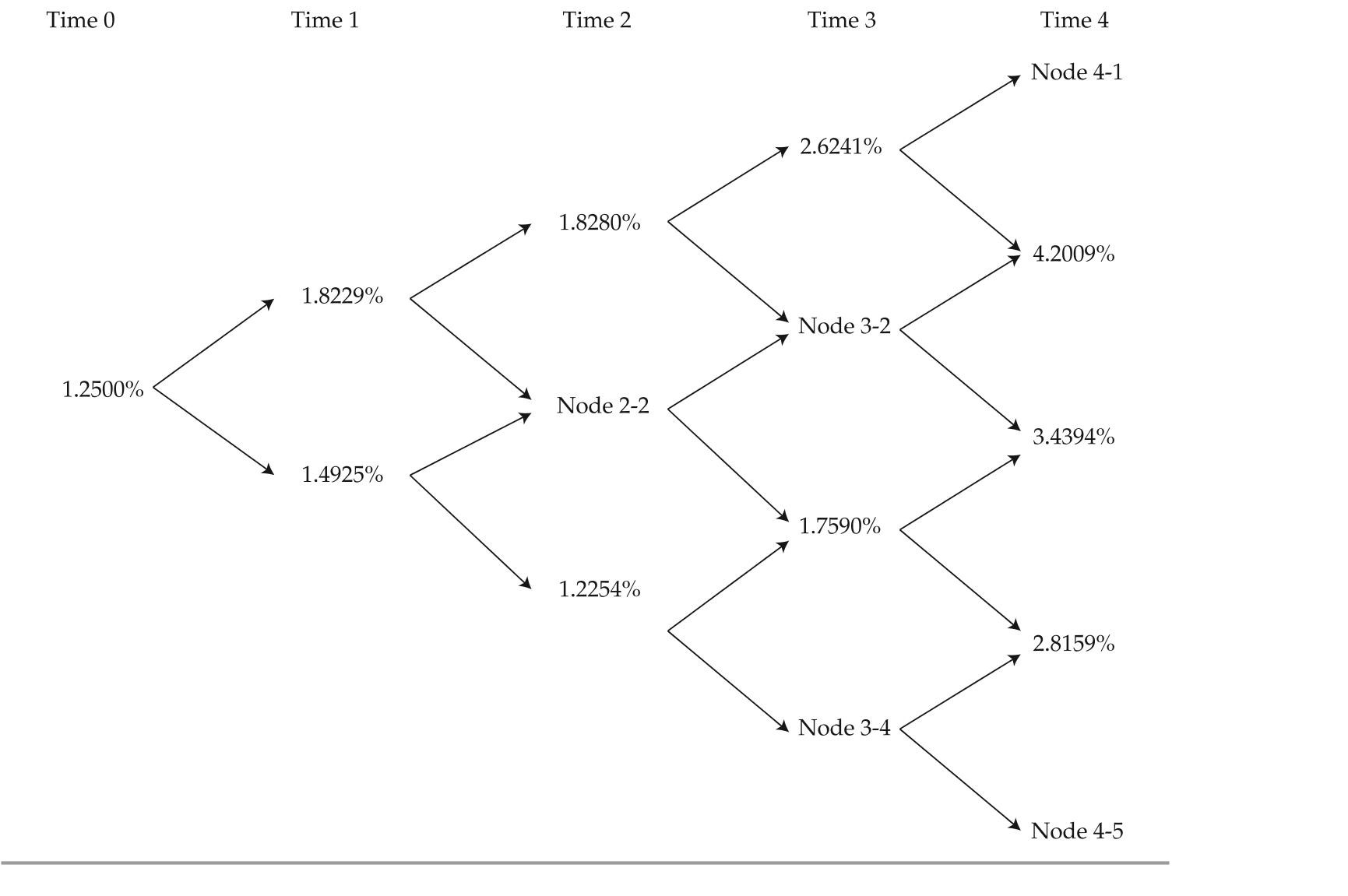

black shows Sun some exhibits that were part of a recent presentation. exhibit 3 presents most of the data of a binomial lognormal interest rate tree fit to the yield curve shown in ex-hibit 2. exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual-pay bond with a 2.5% coupon based on the information in exhibit 3.exhibit 2 Yield to Maturity Par rates for one-, two-, and Three-Year annual-Pay option-Free bonds

exhibit 3 binomial interest rate tree Fit to the Yield Curve (Volatility = 10%)

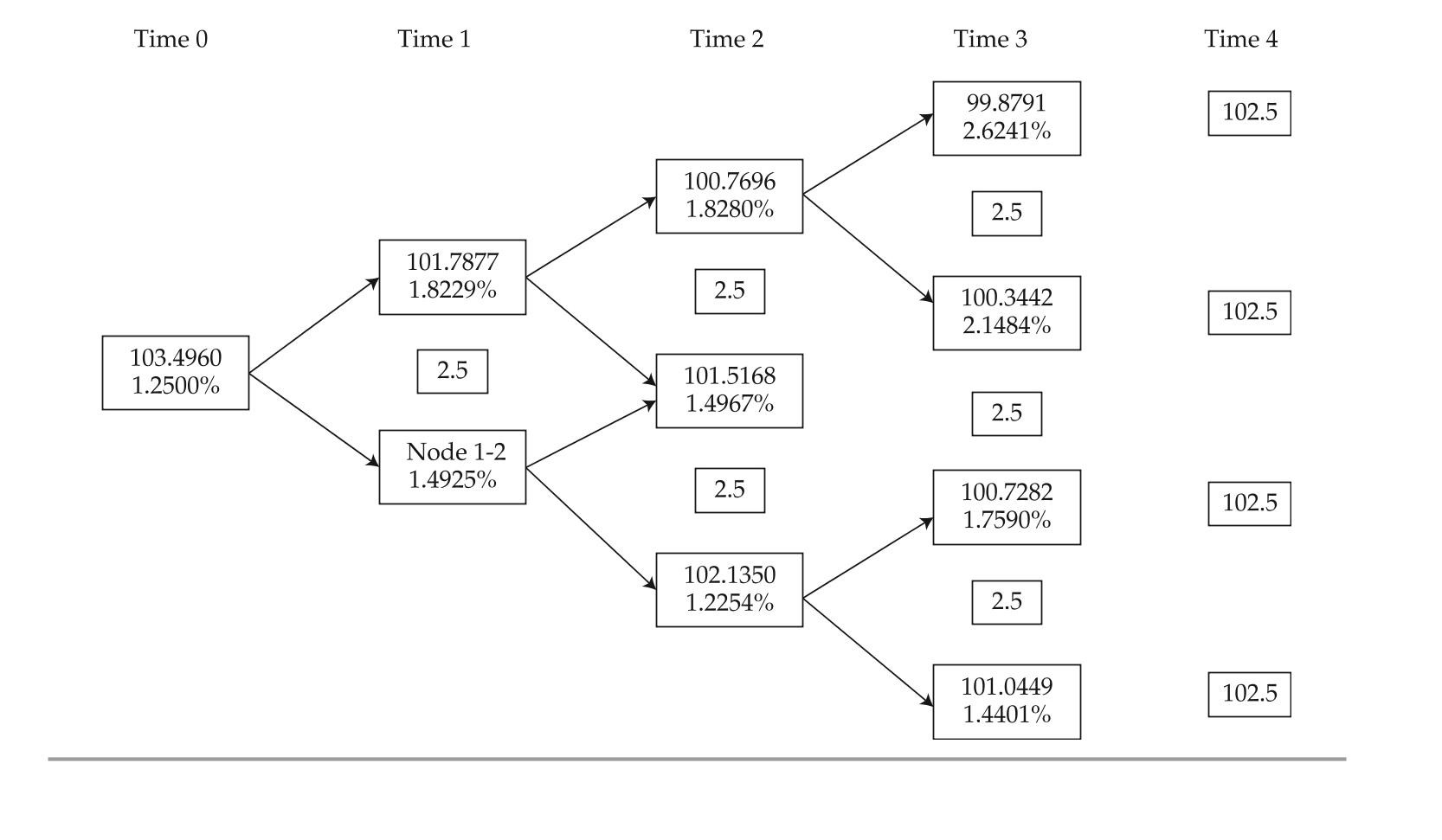

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

task 1 test that the binomial interest tree has been properly calibrated to be arbitrage-free.

task 2 Develop a spreadsheet model to calculate pathwise valuations. to test the ac-curacy of the spreadsheet, use the data in exhibit 3 and calculate the value of the bond if it takes a path of lowest rates in Year 1 and Year 2 and the second lowest rate in Year 3.

task 3 identify a type of bond where the Monte Carlo calibration method should be used in place of the binomial interest rate method.

task 4 update exhibit 3 to reflect the current volatility, which is now 15%.

-based on exhibits 1 and 2, the exchange that reflects the arbitrage-free price of the bond is:

Definitions:

Direct Quotations

The exact words taken from a source and placed into a document or speech, indicated with quotation marks.

Paraphrases

The act of rewording or rephrasing text or speech to achieve clearer understanding, often by simplifying or clarifying the original message.

Quotation Marks

Punctuation marks used to signify the beginning and end of a quotation or a direct speech.

Cupholders

Features in vehicles or furniture designed to securely hold cups or containers.

Q1: Determine the most appropriate immunization portfolio

Q8: Find <span class="ql-formula" data-value="a"><span class="katex"><span

Q16: Which of donaldson's statements is correct?<br>A) only

Q21: Securitization is beneficial for banks because it:<br>A)

Q31: if the market price of Pro Star's

Q37: A 365-day year bank certificate of deposit

Q66: If <span class="ql-formula" data-value="\lim _

Q76: <span class="ql-formula" data-value="\text { Find the limit

Q143: Find the function <span class="ql-formula"

Q159: The monthly cost of driving a