Use the following Exhibit for Questions 39 and 40

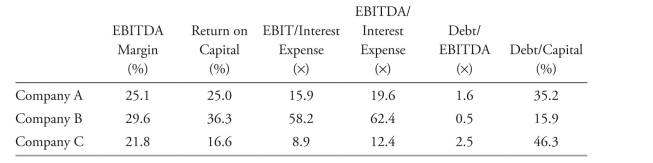

ExHibiT 4 industrial Comparative Ratio Analysis, year 20xx

-based on only the leverage ratios in Exhibit 4, the company with the highest credit risk is:

Definitions:

Strike Price

The fixed price at which the owner of an option can purchase (call) or sell (put) the underlying asset.

Option Price

Option price refers to the premium that must be paid to buy an option, which grants the holder the right, but not the obligation, to buy or sell an underlying asset at a set price.

Risk-Free Rate

The rate of return on an investment with no risk of financial loss.

Call Option

A contractual arrangement in the realm of finance offering the buyer the privilege, though not the compulsion, to procure a share, bond, commodity, or alternate asset at a fixed price throughout a specified duration.

Q1: Two sides of a triangle are

Q2: A point moves along the curve

Q4: Two sides of a triangle are

Q7: based on exhibits 3 and 4, the

Q12: Which of the following is most likely

Q15: Use the linear approximation of the

Q31: if the market price of Pro Star's

Q38: Find the derivative of the function.<br>

Q42: Find the standard form of the

Q93: <span class="ql-formula" data-value="\text { If } g