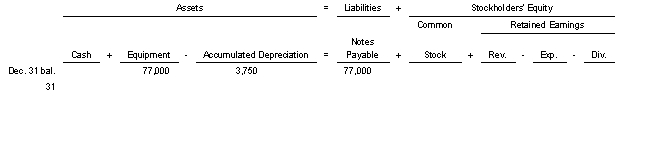

On Oct 1 2021 Metro Company purchased equipment in exchange for a $77000 note payable.The equipment has an estimated salvage value of $17000 an estimated life of 4 years and is depreciated by the straight-line method.Use the following tabular analysis to determine the book value of the equipment at December 31 2022.

Definitions:

False Statements

Intentionally dishonest declarations or representations, especially ones made under circumstances where truthfulness is expected or required.

Tax Returns

The documents filed with a taxing authority that report income, expenses, and other pertinent tax information.

Penalties

Sanctions or punishments imposed for breaking a law, rule, or contract.

Taxpayer

An individual or entity obligated to pay taxes to governmental authorities based on earnings or property ownership.

Q23: The concept that a business has a

Q32: For efficiency of operations and better control

Q37: In periods of falling prices FIFO will

Q45: The net effects on the corporation of

Q104: Inventory methods such as FIFO and LIFO

Q114: Linville Company gathered the following reconciling

Q124: If a retailer sells goods for a

Q137: Allowance for Doubtful Accounts is a contra

Q218: A $150000 bond with a quoted priced

Q230: A corporation purchases 30000 shares of its