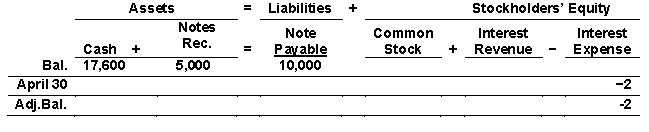

Linville Company gathered the following reconciling information in preparing its April bank reconciliation: Use the following tabular analysis to determine the required adjustment for the notes receivable to Linville's accounts assuming that no interest has been accrued:

Definitions:

Capital Structure

The mixture of debt and equity financing that a company uses to fund its operations and growth.

Q10: Use the following data to determine

Q24: Using the following balance sheet and

Q27: Elston Company compiled the following financial

Q57: Which of the following would <b>not</b> be

Q77: In a period of increasing prices which

Q88: An intangible asset<br>A)derives its value from the

Q96: Use the following data to determine

Q138: Dole Industries had the following inventory

Q151: In a small business the lack of

Q169: An analysis and aging of the