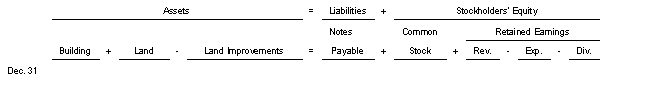

On August 7 Gideon Ridge Restaurant purchased a building in exchange for a note with a face amount of $1660000.The cost of the land was $600000.The building cost $900000 and the parking lot was valued at $160000.Use the following tabular analysis to record the transaction.

Definitions:

Fixed Costs

Expenses that do not change with the level of production or sales activity, such as rent, salaries, and insurance premiums.

Unit Contribution Margin

The difference between the selling price per unit and the variable cost per unit, indicating how much each unit sold contributes to fixed costs and profits.

Break-even Point

The production level at which total revenues equals total expenses, resulting in neither profit nor loss.

Mixed Cost

Expenses that have both a fixed and variable component, changing somewhat in response to changes in production volume or activity levels.

Q7: The safeguarding of assets is an objective

Q46: Kaplan Manufacturing Corporation purchased 2500 shares of

Q65: Information presented in a clear and concise

Q68: On December 1 SJ Company issued 800

Q73: On January 2 2002 equipment with a

Q114: Linville Company gathered the following reconciling

Q118: Which depreciation method is most frequently used

Q154: The collection of an account receivable will

Q162: Sam's Grocery Store has the following policy.'Only

Q182: From an internal control standpoint the asset