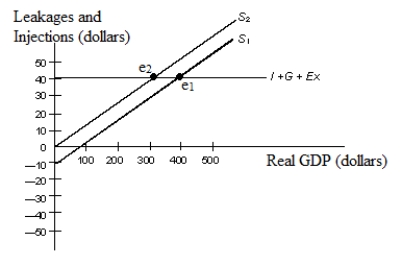

The figure given below represents the leakages and injections in an economy.

Figure 10.3

In the figure:

In the figure:

S1 and S2: Saving functions

I: Investment

G: Government spending

EX: Net exports

-In Figure 10.3, which of the following represents the paradox of thrift?

Definitions:

Progressive

Pertaining to a form of taxation in which the tax rate increases as the taxable amount increases, typically applied to income tax.

Regressive

A term describing a tax system where the tax rate decreases as the taxable amount increases, imposing a greater burden on lower-income earners.

Federal Taxes

Taxes levied by the federal government on income, investments, and goods and services, which fund national programs and services.

State And Local Taxes

Taxes levied by individual states and localities, which can include income, sales, property, and other types of taxes.

Q11: A rightward shift in the aggregate supply

Q17: A progressive tax system is one in

Q22: Which of the following is assumed to

Q33: Calculate the marginal propensity to save for

Q34: The cash reserves held by banks that

Q44: Total reserve holdings over and above required

Q45: Refer to Table 12.2. With a reserve

Q54: Refer to Table 9.1. When disposable income

Q55: Business inventories tend to fall after an

Q128: The Fed controls the money supply to