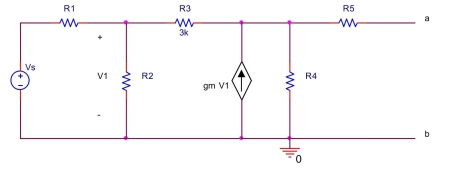

In the circuit shown below, let

Find the Norton equivalent current and the Norton equivalent resistance between terminals and .

Definitions:

Debt-Equity Ratio

A ratio indicating a firm's financial leverage, determined by dividing its total debts by its shareholder equity.

Accounts Receivable Turnover

A financial ratio that measures how efficiently a company collects revenue from its customers by dividing total net credit sales by the average accounts receivable.

Net Working Capital

This is a measure of a company's liquidity, calculated as the difference between its current assets and current liabilities.

Current Assets

Assets that are expected to be converted into cash, sold, or used up within one year or within the normal operating cycle of the business, whichever is longer.

Q1: Find the inverse Laplace transform of

Q1: In Example we added the quadratic terms

Q3: Use the data in BARIUM.RAW for this

Q5: Assume that the model y = X

Q6: Beginning with the 2008 edition of the

Q7: Let A be an n x n

Q7: Type MC cable is a factory assembly

Q13: For a binary response y, let <img

Q13: In Example 11.4, it may be that

Q16: The term means not connected to ground