Heading: Analyzing Risky Decisions

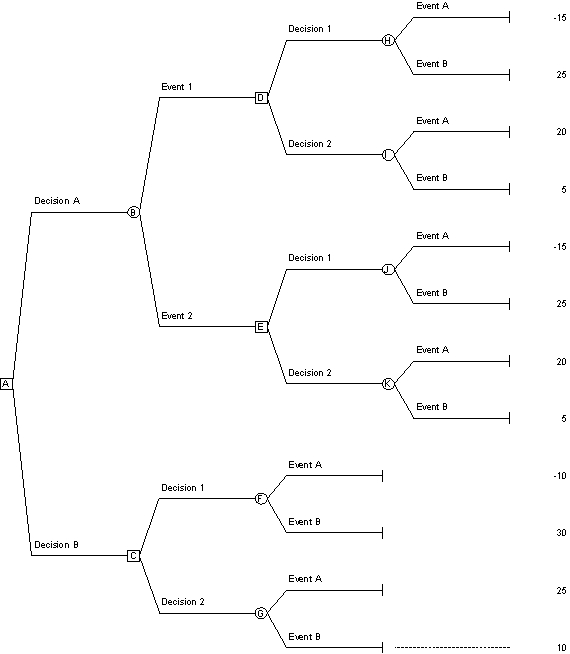

**Reference: Use the decision tree along with the given probabilities to answer the next six questions

Probability Event A = 30% Probability Event B = 70%

Probability Event 1 = 58% Probability Event 2 = 42%

Probability of Event A given that Event 1 occurs = 16%

Probability of Event B given that Event 1 occurs = 84%

Probability of Event A given that Event 2 occurs = 50%

Probability of Event B given that Event 2 occurs = 50%

-A decision tree is:

Definitions:

Fixed Asset Value

The net value of a company's physical assets, like buildings and machinery, after accounting for depreciation or impairment.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the business's normal operating cycle, whichever is longer.

Fixed Assets

Fixed assets, also known as non-current assets, are long-term physical assets used in the operations of a business.

Taxable Income

The portion of an individual's or corporation's income used as a basis for calculating the amount of income tax owed to the government.

Q2: What kinds of publicity would work best

Q4: Opportunity cost is included in the definition

Q5: What does the degree of brand familiarity

Q11: Considering the nature of retail buying, outline

Q12: Helen Troy, owner of three Sound Haus

Q18: How would differences in exchange rates between

Q52: A perfectly competitive firm will always maximize

Q68: In Game 3 above,<br>A)Player A has a

Q78: When a movie theater charges a lower

Q83: Suppose that a market is initially