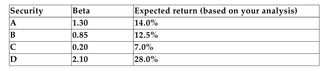

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 13%, and the relevant risk-free rate is 5.5%.

-Refer to the information above. Based on your analysis, which of the securities is overpriced?

Definitions:

Q1: What evaluation technique attempts to compare your

Q4: An investment will cost $1,500 today. You

Q8: What does the two-fund separation theorem state?

Q9: <span class="ql-formula" data-value="\frac { 3 x ^

Q18: The Acorn Project will require an initial

Q21: Refer to the information above. This new

Q41: The stock of Tartan Corporation paid a

Q44: Refer to the information above. Calculate the

Q65: <span class="ql-formula" data-value="x ^ { 2 }

Q117: <span class="ql-formula" data-value="g ( x ) =