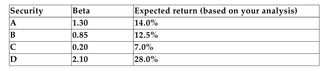

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 13%, and the relevant risk-free rate is 5.5%.

-Refer to the information above. Based on your analysis, which of the securities is overpriced?

Definitions:

Confirmation Bias

The inclination to view new information as support for one's pre-existing opinions or hypotheses.

Fallacy of Popular Appeal

A logical fallacy that argues something is true because it is widely believed or accepted by many people.

Evolutionary Theory

A scientific theory that explains the diversity of life on Earth through the process of natural selection and genetic variation.

Earth is Flat

A debunked belief that the Earth's shape is a plane or disk, contrary to overwhelming scientific evidence of its roundness.

Q3: Decline, Inc. currently produces cash flows of

Q4: The stock of the Narnia Corporation is

Q16: Two mutually exclusive projects have the following

Q17: Which of the following is a random

Q19: A call option<br>A)gives the owner of the

Q27: Which of the following events results in

Q52: Refer to the information above. A stock

Q60: <span class="ql-formula" data-value="\begin{array} { l } x

Q130: <span class="ql-formula" data-value="f ( x ) =

Q267: <span class="ql-formula" data-value="4 x y z ^