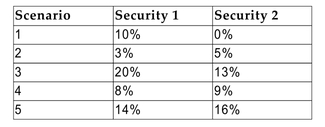

Use a spreadsheet to calculate the variances and standard deviations of the expected

returns for the following two securities as well as the covariance of the two securities

returns:  Assume all scenarios are equally likely to occur.

Assume all scenarios are equally likely to occur.

Definitions:

Unbiased Forward Rate

Theoretically, a forward rate in the currencies market that is equal to the spot rate adjusted for interest rate differentials, without any prediction of future direction.

Forward Rate

The agreed-upon price for a financial transaction that will occur at a future date, often used in the context of foreign exchange or interest rates.

Spot Rate

The current market price of a currency, security, or commodity available for immediate settlement.

Absolute Purchasing Power Parity

A theory that suggests that, in the absence of transaction costs and other barriers, identical goods and services in different countries should have the same price when expressed in a common currency.

Q2: "Tunneling" refers to<br>A)the use of illegal accounting

Q18: When evaluating a project, the chance of

Q24: A U.S. firm invested $800,000 in a

Q48: Refer to the information above. A stock

Q59: The payback period of Project A is

Q64: <span class="ql-formula" data-value="5 ^ { - 1

Q75: <span class="ql-formula" data-value="f ( x ) =

Q109: <span class="ql-formula" data-value="f ( x ) =

Q142: <span class="ql-formula" data-value="| 0 |"><span class="katex"><span class="katex-mathml"><math

Q152: <span class="ql-formula" data-value="( - 7 ) ^