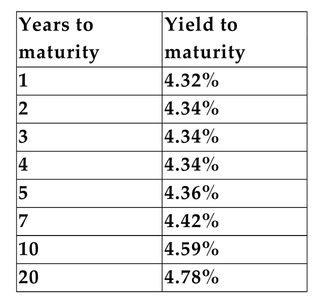

Assume that the following data on U.S. Treasury securities is current:

-Refer to the information above. What is the implied interest rate on a one-year Treasury issued two years from today?

Definitions:

Tchebysheff's Theorem

A statistical theorem that provides a bound on the probability that the value of a random variable deviates from its mean by more than a certain multiple of its standard deviation.

Standard Deviations

Measures the amount of variation or dispersion from the mean in a set of data points.

Empirical Rule

A statistical rule stating that for a normal distribution, nearly all data will fall within three standard deviations (denoted as sigma) of the mean.

Numerical Descriptive Measures

Statistics that quantitatively describe or summarize features of a collection of information, such as mean, median, mode, and range.

Q17: A market-maker<br>A)buys and sells securities out of

Q21: The capital market line depicts the relationship

Q38: Which of the following is not an

Q47: For IPOS that are less than $100

Q49: A type of offering that allows existing

Q54: List five differences between regular stock options

Q59: The payback period of Project A is

Q201: <span class="ql-formula" data-value="- \frac { 7 }

Q232: -(-x)= x<br>A)inverse property of multiplication<br>B)double negative property<br>C)identity

Q288: <span class="ql-formula" data-value="- 3 x ^ {