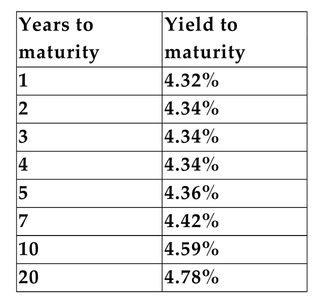

Assume that the following data on U.S. Treasury securities is current:

-Refer to the information above. You purchase a $1,000, zero-coupon, Treasury bond that matures in five years. Assume the term structure remains constant and that you sell the bond

After holding it only three years. For what price can you sell it?

Definitions:

Property Rights

Legal rights to possess, use, and dispose of assets including real estate, intellectual property, and tangible goods.

Economic Efficiency

A measure of how well scarce resources are utilized for producing goods and maximising the satisfaction or utility of consumers.

Market Equilibrium

A condition where the supply and demand in the market equilibrate, leading to stable prices.

Economic Efficiency

The optimal allocation of resources to maximize the production of goods and services, achieved when no further gains can be made without disadvantages.

Q1: What feature distinguishes the asset class, BONDS,

Q3: The correlation of the returns of a

Q5: A project has an asset beta of

Q9: Refer to the information above. What is

Q27: The real interest rate is 1.8% per

Q32: An American investor invested in British Airways

Q34: Refer to the information above. Which of

Q238: <span class="ql-formula" data-value="- ( - 3 )

Q293: <span class="ql-formula" data-value="| - 25 | +

Q295: <span class="ql-formula" data-value="\frac { 6 \times 10