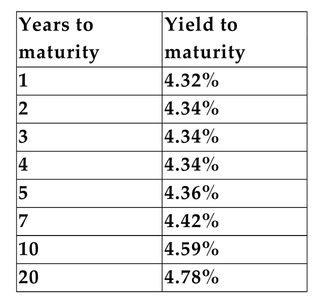

Assume that the following data on U.S. Treasury securities is current:

-Refer to the information above. You purchase a $1,000, zero-coupon, Treasury bond that matures in five years. Assume the term structure remains constant and that you sell the bond

After holding it only three years. For what price can you sell it?

Definitions:

Q10: What are some useful non-control functions performed

Q10: A spread involves<br>A)buying one option and shorting

Q12: Refer to the information above. What is

Q21: Which of the following investment categories is

Q25: In what three situations does the corporate

Q31: Jason wishes to be able to receive

Q37: Assume a 1-year Treasury security offers a

Q44: Why would a firm choose to issue

Q51: A project will cost $250,000 and is

Q275: (9 ·8)·5 = 9 · (8 ·5)<br>A)commutative