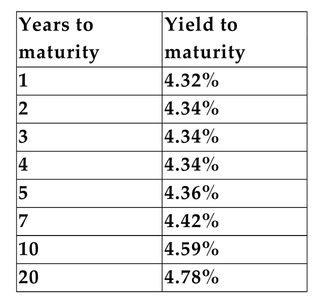

Assume that the following data on U.S. Treasury securities is current:

-Refer to the information above. You purchase a $1,000, zero-coupon, Treasury bond that matures in seven years. Assume the term structure remains constant and that your sell the

Bond after having held it only 5 years. At what price should you be able to sell it?

Definitions:

Expected Value

The weighted average of all possible values of a random variable, representing the long-term average outcome of a given situation if it were to be repeated many times.

Simple Linear Regression

A statistical method for estimating the relationship between two quantitative variables, allowing predictions of one variable given the other.

True Correlation

The actual degree of a linear relationship between two variables, excluding any error or distortion.

Linear Relationship

A type of correlation where there is a constant change rate between two variables, indicative of a straight line when graphed.

Q2: If the mass of an object

Q11: <span class="ql-formula" data-value="- \sqrt { 64 }"><span

Q18: Which of the following statements about purchasing

Q18: The term structure of interest rates depicts

Q22: Which of the following statements about proxy

Q29: You have just won a lottery that

Q33: Refer to the information above. This new

Q43: You purchase both a call option and

Q44: Which of the following accounts would not

Q54: The underwriting spread will be higher,<br>A)the riskier