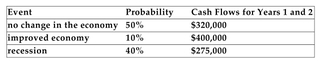

Project B is a 2-year project that will cost $550,000. You have estimated the following probability distribution for the project's future annual cash flows:

-Refer to the information above. Assume the relevant cost of capital is 10%. What is Project B's NPV? Round your answer to the nearest dollar.

Definitions:

Cross-Hedging

A strategy used to manage risk by hedging a position in one asset with a position in another asset that has a similar price movement but is not identical.

Bauxite

The primary ore of aluminum, consisting primarily of aluminum oxide minerals, clay minerals, and insoluble materials.

Aluminum Ore

The natural mineral compound from which aluminum is extracted, primarily bauxite.

Aluminum Futures

Contracts to buy/sell aluminum at a future date at a price agreed upon today, used for hedging or speculation on the aluminum market.

Q4: If a manager is evaluating a project

Q8: The M&M proposition says that if a

Q12: Refer to the information above. What is

Q13: A certain project will cost a firm

Q13: What is the corporate charter, and what

Q18: Using a graphing calculator as needed, maximize

Q26: Which of the following is a valid

Q35: You can earn 4% on your bank

Q49: Felix Industries' 2007 annual report contained the

Q77: Month: May (31 days) Previous month's balance: