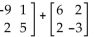

Perform the operation, if possible.

--- 2

Definitions:

Efficient Tax System

A tax system that collects required revenue without excessive government borrowing, and does so in a way that does not impede economic growth.

Tax Revenues

The income that is received by the government from taxpayers, including individuals and businesses, to fund public expenditures.

Deadweight Loss

The loss of economic efficiency that can occur when the equilibrium for a good or a service is not achieved or is not achievable.

Marginal Tax Rate

The rate at which your last dollar of income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Q7: Write te <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt="Write te

Q18: 3.5% compounded continuously.<br>A) 3.50%<br>B) 3.53%<br>C) 3.55%<br>D) 3.56%

Q20: The access code to a house's security

Q24: Refer to the information above. All else

Q32: Company A rents copiers for a monthly

Q38: An ordinary annuity has a value of

Q44: If n(A) = 5, n(B) = 11

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A) (1, 2)

Q55: Which of the following is an example

Q86: 6!<br>A) 1440<br>B) 120<br>C) 720<br>D) 360