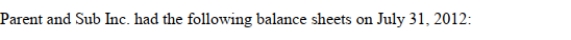

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

Definitions:

Thick

Having a large distance between opposite sides or surfaces; not thin.

Vesicles

Small cavities in volcanic rocks created by the expansion of gas bubbles during solidification of the magma.

Flow Bands

Visible layers or bands in volcanic rocks that indicate the flow direction of the magma from which the rocks formed.

Igneous Rock

Rock material that has solidified and crystallized from molten magma or lava.

Q3: Sonic Enterprises Inc has decided to purchase

Q6: When the acquisition differential is calculated and

Q10: If the joint production costs are allocated

Q19: Many people think that a national

Q21: What monumental decision to change the requirements

Q26: Which of the following methods recognizes the

Q33: Assume that two companies wish to engage

Q58: King Corp. owns 80% of Kong Corp.

Q70: The largest professional association for management accountants

Q84: To select the correct Student's t-distribution