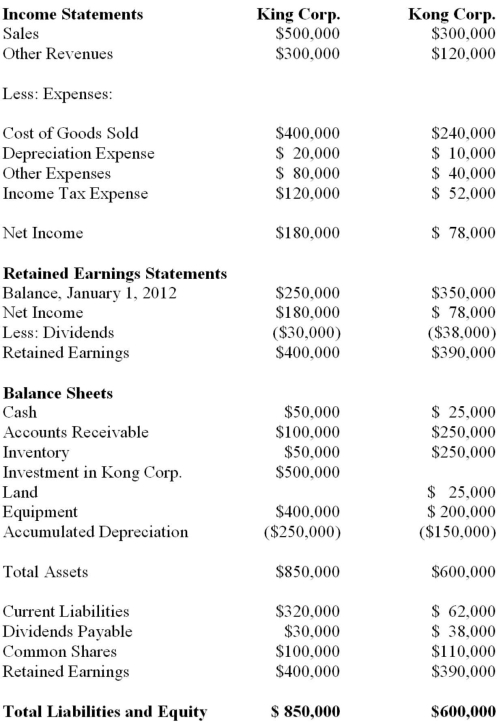

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Statement of Financial Position for inventories?

Definitions:

Emotional Intelligence Test

An assessment designed to measure an individual's ability to perceive, use, understand, manage, and regulate emotions in themselves and others.

Future Emotions

Anticipated feelings about events or experiences that are yet to occur.

Predict

The act of forecasting future events or conditions based on current knowledge or data.

Somatic Marker Hypothesis

A theory suggesting that emotional processes guide (or bias) behavior, particularly decision-making, via bodily feelings.

Q1: Which of the following statements represents a

Q3: When an investment is accounted for using

Q14: Telecom Inc has decided to purchase the

Q14: Errant Inc. purchased 100% of the outstanding

Q27: Find Corp and has elected to use

Q40: Which of the following would not be

Q41: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $136,920. B)

Q41: Duff Inc. owns 75% of Paddy Corp.

Q49: Let to be a specific value

Q109: For the year just ended, Porter Corporation's