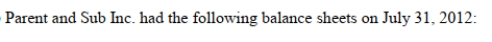

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc acquires 80% of Sub Inc on August 1, 2012, what amount would appear in the Non- Controlling Interest Account on the Consolidated Balance Sheet on the date of acquisition if the Proprietary Method were used?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc acquires 80% of Sub Inc on August 1, 2012, what amount would appear in the Non- Controlling Interest Account on the Consolidated Balance Sheet on the date of acquisition if the Proprietary Method were used?

Definitions:

Contractual Liability

The liability that individuals or entities have to one another as a result of entering into an agreement.

Common Law

A system of law based on precedent and customs rather than statutory laws.

Gap-Filling Rules

Provisions in law that allow courts or parties to fill in missing terms in a contract.

Sale Of Goods

The transfer of ownership to tangible personal property in exchange for money, other goods, or the performance of service.

Q14: A local outdoor equipment store is

Q14: Which of the following bodies oversees audits

Q27: A not-for-profit organization receives a restricted contribution

Q31: Construct a <span class="ql-formula" data-value="99

Q38: State Hospital has two service departments (Patient

Q39: Parent and Sub Inc. had the following

Q45: Dodge City Corporation is developing departmental overhead

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Assuming

Q58: The value chain is a key component

Q71: Which of the following methods recognizes some