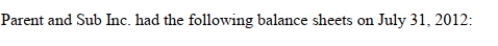

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming Parent purchased 80% of Sub Inc. for $180,000; the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under the Entity Method?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming Parent purchased 80% of Sub Inc. for $180,000; the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under the Entity Method?

Definitions:

Face Value

The nominal or original value stated on a coin, banknote, security, or any other financial instrument, without accounting for inflation, interest, or any other market factors.

Interest Rate

The percentage at which interest is paid by borrowers for the use of money they borrow from a lender.

Reserve Requirement

The portion of depositors' balances that banks must have on hand as cash, a regulation set by central banks to ensure liquidity.

Deposit Multiplier

The ratio that describes the potential increase in bank deposits that can result from an increase in banks' reserves through the fractional reserve banking system.

Q5: Consider the following statements about service department

Q14: The reciprocal-services method cannot be combined with

Q16: The time value of money and present

Q21: On that date, which of the following

Q22: The time value of money and present

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q30: King Corp. owns 80% of Kong Corp.

Q40: John Inc and Victor Inc for its

Q49: Ting Corp. owns 75% of Won Corp.

Q115: You are performing a study about