The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

Definitions:

Neurons

Specialized cells of the nervous system that transmit information to other neurons, muscles, or glands through electrical and chemical signals.

Microglia

Specialized cells in the brain and spinal cord that act as the main form of active immune defense in the central nervous system.

Ventricles

Cavity or space within the brain filled with cerebrospinal fluid that helps protect the brain and spinal cord and provides nutrients.

Cerebrospinal Fluid

Cerebrospinal fluid is a clear, colorless body fluid found in the brain and spinal cord, providing cushioning and maintaining a stable environment.

Q9: Assuming use of the step-down method, over

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q18: Ting Corp. owns 75% of Won Corp.

Q24: Which of the following would be most

Q28: Smith is a weld inspector at

Q32: Which of the following is NOT currently

Q33: The consolidation elimination entry required to remove

Q36: Parent and Sub Inc. had the following

Q47: In the net-realizable-value method, the joint cost

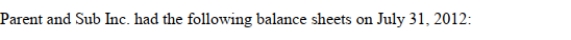

Q71: The position of chief financial officer (CFO)