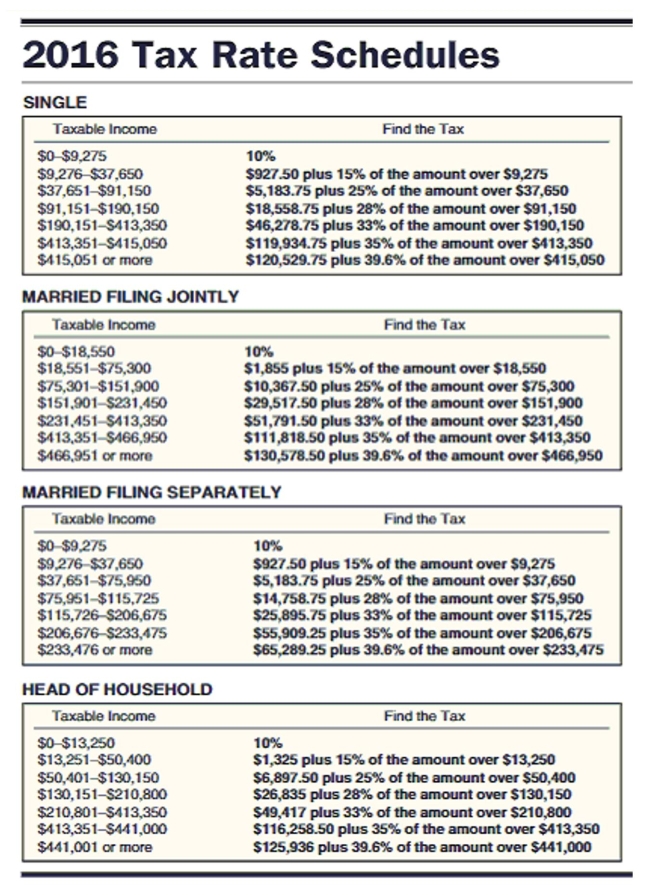

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Megan Cortez had an adjusted gross income of $55,704 last year. She had deductions of $939 for state income tax, $764 for property tax, $3,890 in mortgage interest, and $1,294 in contributions. Cortez claims one exemption and files as a single person.

Definitions:

Q9: Each year, 104 people move from Babbittown.

Q9: 30 years<br>A)1.7%<br>B)30%<br>C)0.3%<br>D)3.3%

Q10: A utilitarian believes that pain is inherently

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)1,381,000 B)1,380,000 C)1,379,501

Q31: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q36: 6,433 to the nearest hundred<br>A)6,300<br>B)6,400<br>C)6,410<br>D)6,500

Q37: The following chart shows HealthTech's monthly sales

Q38: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$3,800 B)$700 C)$3,750

Q48: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" List all countries

Q48: The Montgomerys borrowed $88,000 at <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg"