Select the correct Answer for each question.

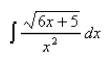

-Use a table of integrals to evaluate the integral.

Definitions:

Beginning Finished Goods

The inventory of finished products available for sale at the start of an accounting period.

Ending Finished Goods

The value of goods available for sale at the end of an accounting period.

Production Budget

An estimate of the total cost of production, including materials, labor, and overhead, for a specific period.

Beginning Finished Goods

Refers to the inventory of completed products that a company has on hand at the start of an accounting period.

Q4: What level of knowledge is your audience

Q13: Find the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Find the

Q16: Find the length of the curve. <img

Q20: Find the volume of the solid generated

Q60: Use long division to evaluate the integral.

Q95: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="If find

Q102: Find the indefinite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Find

Q128: Evaluate the following integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Evaluate

Q132: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Let be

Q142: Find the area of the surface obtained