SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (

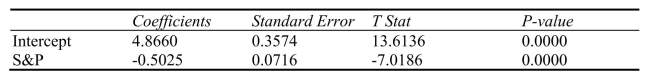

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (  X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the appropr  iate null and alternative hypotheses are, respectively,

iate null and alternative hypotheses are, respectively,

Definitions:

Receivables

Money owed to a business by its clients or customers for goods or services delivered but not yet paid for.

Favorable Lending

Financial conditions or loan terms that are advantageous to the borrower, such as lower interest rates or flexible repayment schedules.

Loan Officer

A financial professional responsible for evaluating, authorizing, or recommending approval of loan applications for people and businesses.

Entrepreneur's Ability

The set of skills, knowledge, and competencies that enable an individual to innovate, start, and successfully manage business ventures.

Q7: Referring to Scenario 12-11, the null hypothesis

Q33: Referring to Scenario 13-11, which of the

Q50: Referring to Scenario 14-5, what is the

Q88: Referring to Scenario 12-7, the value of

Q135: Referring to Scenario 13-3, suppose the director

Q163: Referring to Scenario 13-12, there is no

Q168: Referring to Scenario 14-17, what is the

Q196: Referring to Scenario 13-10, construct a 95%

Q236: Referring to Scenario 14-9, what is the

Q286: Referring to Scenario 14-18, what is the